The 9-Minute Rule for Tax Debt Relief

Table of ContentsTax Debt Relief for BeginnersThe Basic Principles Of Tax Debt Relief Facts About Tax Debt Relief RevealedAn Unbiased View of Tax Debt ReliefTax Debt Relief - The Facts7 Easy Facts About Tax Debt Relief Described

Are you asking yourself if IRS financial obligation forgiveness is feasible? The brief solution is Yes, but it's finest to employ expert assistance to get that forgiveness. Take a look at what every taxpayer requires to find out about the internal revenue service financial obligation forgiveness program. What Is the IRS Financial Obligation Forgiveness Program? The IRS supplies a number of alleviation choices for taxpayers that owe unpaid taxes.Bear in mind the IRS will certainly not consider you for any type of tax alleviation benefits unless every one of your income tax return from current and also previous years have been submitted. The internal revenue service won't hold the fact that you've submitted returns late versus you when assessing your eligibility, so if you have unfiled income tax return, getting current is the initial step to being approved financial obligation mercy. Nevertheless, settlement may not be the very best option for you. You might actually be able to pay much less general with something like a Deal in Compromise or Currently Non Antique condition. It is very important to note that both of these alternatives need you to disclose financial information to the internal revenue service. The last point you desire to do exists details that contradicts your case that you're incapable to pay your tax expense.

Call now to start the procedure of freezing fines and also getting debt got rid of away.

The Ultimate Guide To Tax Debt Relief

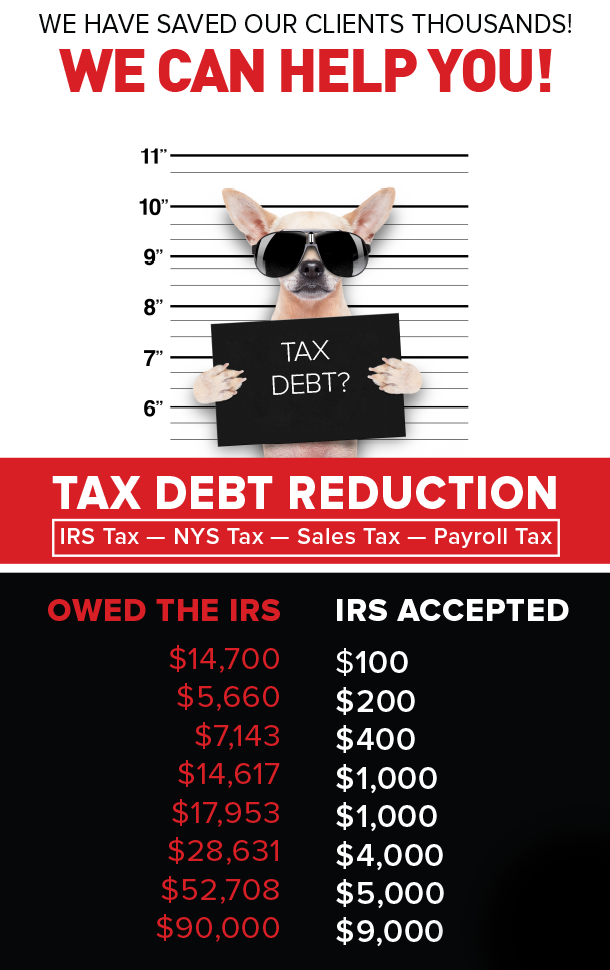

Although there might be a few attorneys and also a handful of people in the company who did help the IRS at some factor, most of staff members possibly haven't. Actually, the majority of staff members might be little greater than minimum-wage customer support reps. What Tax Settlement Firms Offer Most tax obligation negotiation companies assure to send their professionals to the IRS to discuss in support of the client, where they can most likely convince the company to accept a much smaller amountoften cents on the dollar.

This is a special contract that some taxpayers can make with the IRS to settle their tax financial debts for a minimal quantity than what is owed.

Not known Facts About Tax Debt Relief

The number of offer-in-compromise applications that are actually approved is usually very reduced. To have such a decrease accepted, taxpayers must confirm that the complete amount owed is wrong, the likelihood of having the ability to repay the sum total is very reduced, or repaying the total will certainly cause incredible economic hardship.

This is typically the amount of money the company states it will certainly conserve the client in tax payments. Customers have actually complained to the Better Company Bureau (BBB) and the Federal Profession Payment (FTC) that some of these firms have not generated any one of the assured results and also, as a matter of fact, the organization was a fraud.

Any type of reputable tax relief firm will certainly first acquire essential monetary data from its consumers prior to providing a realistic evaluation of what they can do for a sensible set fee. Prospective customers would be smart to find a local company that has actually been in service for numerous years and also has an existence in the area.

The Only Guide to Tax Debt Relief

The internal revenue service previously provided warnings to the public regarding illegal companies, pointing out a number of the issues provided here. If you can not pay your taxes, understand that the IRS has many methods for accumulating what you owe. Publication 594: The IRS Collection Refine supplies a comprehensive summary of the Offer in Concession process as well as a summary of the collections process.

On the various other hand, good companies bill reasonable, transparent fees and also have actually confirmed track documents. Some firms bill a level portion of the quantity owed to the Internal revenue service, such as 10%.

While several taxpayers obtain refunds at tax time, coming up brief is not unusual. Recently, roughly 20% of taxpayers one in 5 file a return with a debt of concerning $3,000. (Recommendation: File your tax obligations! Even if you're not able ahead up with the payment; after that contact the company regarding obtaining out of federal hock.)Luckily, because what the IRS (and also any type of various other tax-enforcement firm) truly desires is what the government is owed, there are means out of tax-debt problem.

Facts About Tax Debt Relief Uncovered

Which one is appropriate for the tax-debtor rest on his/her overall economic problem. That might require tax-debt alleviation? Taxpayers that have fallen behind as well as lack the resources to pay their financial debt via individual loan, residence equity lending, credit card, investments, etc. Taxpayers behind that have concerned the attention of exclusive debt collectors worked with by the IRS.Those that have actually stopped working to submit tax returns for any number of years, yet that have (so far) handled to operate beneath the radar of the IRS.Taxpayers whose debt is so "seriously delinquent" ($50,000 or even more) the internal revenue service has advised the State Division to reject, revoke or confiscate their keys.

Any of the programs can be self-initiated by the taxpayer. Nonetheless, for those reluctant to go it alone, a tax-settlement industry has arised to assist customers navigate the firm's guidelines. In ads, some of the gamers assert excellent credentials, experience, and incredible outcomes. Look out (Tax Debt Relief). While the majority of tax obligation negotiation solutions proclaim lineups of former internal revenue service agents and also other tax experts ready to use their proficiency to slash what you owe, the truth is something various.

Not known Facts About Tax Debt Relief

The IRS evaluates a host of factors, among them capability to pay, income, expenses, and property equity. The firm usually approves an offer in concession just when the quantity offered represents the most it pop over here can anticipate to gather in a practical time period. Applications have to be accompanied by a repayment of 20% of the overall offer amount, plus check it out a nonrefundable $186 charge.